Temporibus autem quibusdam

Beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt omnis iste natus error sit voluptatem accusantium.

Get StartedAbout FNet

Who We Are and What We Do

FNet was created with a clear mission: to support veterans' charities by generating funds through the provision of home insurance.

Our aim to give back to a community that has given so much for the safety and protection of others.

To achieve this, our industry experts have created a comprehensive home insurance product that will keep your home and belongings protected.

And for every home insurance policy sold, 5% of the premium will be donated to a veterans' charities.

And to further demonstrate our support for the Armed Forces Community, we are proud to have signed up to the Armed Forces Covenant.

FNet is a trading name of Integra Insurance Solutions, a leading specialist insurer in Home Insurance within the UK.

Why use FNet

- Home insurance cover that genuinely makes a difference and directly gives back to the veterans' community, with 5% of all premiums donated to veterans' charity.

- Insurance cover provided by genuine experts, with long-standing pedigree in the home insurance market.

- Comprehensive home insurance cover for both buildings and contents, for 1-5 bedroom houses in the UK.

- Cover for personal items anywhere in the UK, with worldwide cover up to 60 days.

- In-house claims handlers provide a high level of customer service from receipt of claim through to settlement.

- Online 24/7 claims portal means that claims can be logged easily at your earliest convenience.

- 24 hour helpline services provide you with easy access to guidance to deal with all kinds of events and emergencies. These include legal advice, health and medical information, counselling and much more.

The FNet offering is still in development - we are constantly looking at ways we can refine our service to give you the best possible customer experience and ensure that we are contributing to the veterans' community in the right way.

We are also actively reviewing data and our quotability to make our product available to more households, so if you can't get a quote with us at this time you may be able to in the future.

Thank you for using FNet, if you have any feedback at all, please email home@f-net.co.uk

Making it easy to get a Home Insurance Quote

Our new Home Insurance products are built on a modern, user-friendly platform, allowing you to receive a selection of quotes in just minutes.

We offer four levels of coverage—Bronze, Silver, Gold, and Diamond—each customisable to suit your specific needs.

Who is Eligible?

Veterans, the serving community as well as your friends, family, colleagues, and anyone else who would like to support this initiative.

My Home Insurance is due within the next 30 days

If your Home Insurance is due within the next 30 days, simply click the 'Get a Quote' button to get your quotes. If you like the quote and choose to purchase your insurance through us, we'll donate a portion of the premium to a veterans' charities.

My Home Insurance is not due yet

If your Home Insurance isn't due yet, but you'd like to stay informed, click the 'Remind Me Later' button. Just leave your name, email address, and the date your insurance is due, and we'll send you a reminder closer to the time.

Our Work in the Armed Forces Community

As a show of our commitment to the veterans community, we are proud to have signed up to the Armed Forces Covenant demonstrating our support to all individuals serving the Armed Forces and their families

Bagpipes in for the 80th Anniversary of D-Day

FNet supported an incredibly special and unique event on the 80th anniversary of D-Day. We provided a bespoke set of bagpipes to 21-year-old Alex Smith. Following in the footsteps of Piper Bill Millin 80 years earlier, Alex played the pipes off a Royal Marine landing craft coming ashore on Sword Beach. After playing Road to the Isles and Highland Laddie on the sands, Alex followed the Commando Route 10km to Pegasus Bridge where he crossed playing Blue Bonnets. In the evening, Alex played a sunset ceremony as beacons were lit to mark the end of the longest day.

The Rawthey Project

FNet were delighted to recently donate £250 to The Rawthey Project. Based in Sedbergh, the Rawthey Project was established for the benefit of the community and in particular the Armed Forces, Emergency Services, and NHS communities. It aims to support the most disadvantaged and vulnerable in these communities through connecting them with volunteers who will assist in times of need, with help from specialist clinical and social care teams.

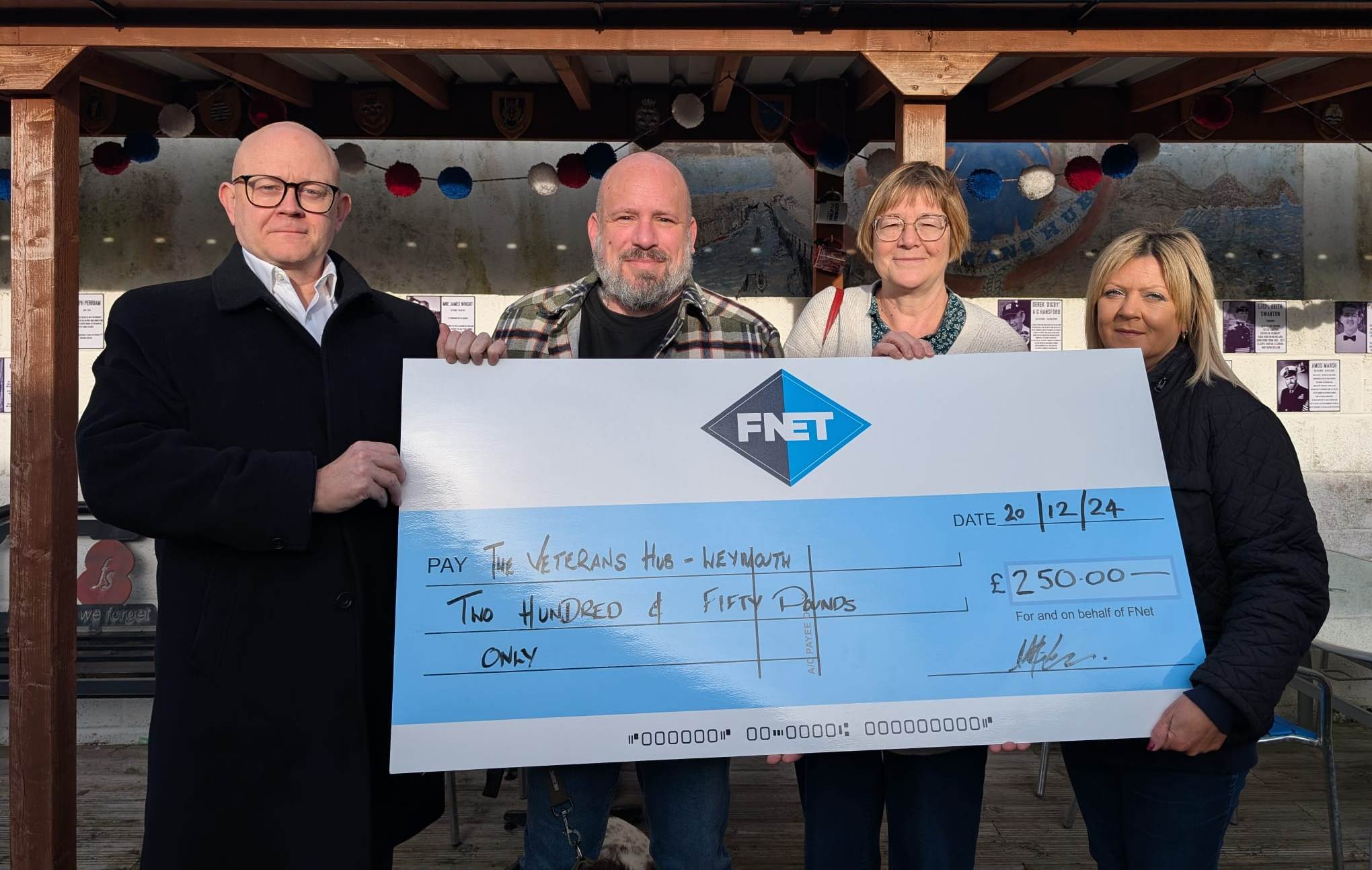

The Veterans Hub Weymouth

FNet are proud to be able to support our friends at the Veterans Hub in Weymouth. We recently donated £250 to the organisation, which is a community project that was set up with the intent of providing a safe and secure location for veterans and their families to come together in an environment that would enable them to socialise in a non-clinical setting in order to provide peer-to-peer support for each other.

Honouring Heritage and Legacy

At FNet, our mission goes beyond providing reliable home insurance. We are deeply committed to honouring the men and women who have served in the armed forces, preserving their legacy, and giving back to the veterans' community through charitable contributions.

Carrying on Tradition

Throughout history, veterans have played a critical role in safeguarding our freedoms. Their stories remind us of the values we hold dear: honour, service, and commitment to others. By supporting veterans' charities through every home insurance policy sold, we are doing our part to carry this legacy forward.

With each policy, a portion of the premium is donated directly to veterans' charities, ensuring that the community that has given so much continues to receive the support and recognition it deserves. This partnership allows us to help protect your home whilst honouring those who have protected our country.

By choosing FNet, you're making a conscious decision to help the veteran community, while ensuring that the traditions of bravery, sacrifice, and service continue to be honoured and respected across the UK.

What Type of Home Insurance cover do I need?

Combined insurance

Offers both buildings and contents coverage in a single policy. This is the most popular form of home insurance as it offers maximum and comprehensive cover for your home and its belongings. It also means that, should something happen to both your building and its contents, it will be dealt with in one single claim, instead of two separate ones.

Contents insurance

Contents insurance covers the belongings inside your home, such as furniture, electronics, and home office equipment—basically, anything you'd take with you if you moved. This policy protects these items from theft, vandalism, fire, and water damage. You can customise your coverage with optional extras to suit your needs.

Buildings insurance

If you need buildings insurance only, we have you covered. Our buildings insurance policy protects the structure of your home, including walls, windows, and permanent fixtures like kitchens and bathrooms. It also extends to outbuildings such as garages (provided they are situated within the boundaries of the risk address shown in the Summary of Cover), as well as any drains and pipes you're responsible for.

How can I get a quote?

To get a Home Insurance quote, you'll need to provide some key information. We use this information to assess the insurance risk and provide you with a price accordingly.

Personal details

Information such as your name, date of birth, and any home insurance claims made in the past five years.

Property details

Information about your home, such as its postcode, ownership status, whether you live there full-time, the year it was built and the materials used for the walls and roof. You'll also need to confirm if your home has ever experienced flooding.

Belongings

A list of your contents, including valuables like jewellery, watches, and items worth over £2,000, plus other personal possessions, bicycles/pedal cycles, and any special collections.

Policy preferences

The amount you're willing to pay as an excess on claims and any optional add-ons you'd like.

What effects the cost of my home insurance?

The higher the risk of loss or damage to your home and belongings, the more expensive your insurance quote is likely to be.

Your premium is influenced by various factors related to you, your home, and the value of your possessions.

Location & Proximity to Water

Such as living in a city with a higher crime rate or a rural spot exposed to harsh weather can all increase your insurance costs.

Homes near rivers or coastlines also often have a higher insurance cost due to the increased risk of flooding.

House Size & Value of Belongings

If your home is large, the cost to rebuild it may raise the building portion of your quote.

Along with this, the more valuable your possessions, the higher the cost to insure them.

Age, Construction of Your Property and Roof Materials

The age of your home and the materials used in its construction significantly impact your quote.

For example, older properties are often more expensive to repair then new-build properties.

Lifestyle Factors

Factors such as your credit score, occupation and how often you're away from home can affect your insurance quote.

Previous Claims

Even if you've moved to a new home, your past claims history is still considered. Failing to disclose this information could invalidate your policy.

Additional Coverage Options

Explore optional add-ons like accidental damage cover, family legal expenses, key protection and home emergency assistance to enhance your policy and ensure comprehensive protection for your home.

Cover Comparison

| Buildings Insurance | Bronze | Silver | Gold | Diamond |

|---|---|---|---|---|

| Buildings Cover | £500,000 | £1,000,000 | £1,000,000 | £1,000,000 |

| Buildings Excess | £100 | £100 | £100 | £100 |

| Buildings Accidental Damage Cover | Not Included | Not Included | Not Included | Included |

| Buildings Alternative Accommodation cover | £100,000 | £200,000 | £200,000 | £200,000 |

| Subsidence excess | £1,000 | £1,000 | £1,000 | £1,000 |

| Escape of Water Excess | £350 | £350 | £350 | £350 |

| Compulsory evacuation | Up to £250 per 24-hour period for a maximum of 7 days | Up to £250 per 24-hour period for a maximum of 7 days | Up to £250 per 24-hour period for a maximum of 7 days | Up to £250 per 24-hour period for a maximum of 7 days |

| Trees, plants & shrubs | Up to £1,000 for any one claim, with a limit of £100 per item | Up to £1,000 for any one claim, with a limit of £100 per item | Up to £1,000 for any one claim, with a limit of £100 per item | Up to £1,000 for any one claim, with a limit of £100 per item |

| Contents Insurance | Bronze | Silver | Gold | Diamond |

|---|---|---|---|---|

| Contents Cover | £50,000 | £75,000 | £100,000 | £125,000 |

| Contents Excess | £100 | £100 | £100 | £100 |

| Accidental Damage Cover | Not Included | Not Included | Not Included | Included |

| Maximum Valuables limit | £15,000 | £22,500 | £30,000 | £37,500 |

| Maximum cover per valuable | £5,000 | £7,500 | £10,000 | £12,500 |

| Alternative Accommodation | £10,000 | £15,000 | £20,000 | £25,000 |

| Escape of Water Excess | £350 | £350 | £350 | £350 |

| Max. cover for Personal Possessions | £7,500 | £10,000 | £12,500 | £15,000 |

| Maximum cover per item | £5,000 | £7,500 | £10,000 | £12,500 |

Frequently Asked Questions

How much should I insure my Contents for?

This should be sufficient to cover the cost of replacing as new all of your possessions. You should include furniture, carpets, curtains, and all your valuable items, such as jewellery and works of art. You do not need to include any items classed as fixtures and fittings, such as bathroom suites and fitted kitchens.

What do you mean by 'how many continuous years have you had home insurance?'

We are referring to the number of years you have held home insurance without a break in cover for more than 30 days.

Why isn't my postcode or my house number/name listed?

If you are unable to locate your postcode, house number or house name when doing an address search, this unfortunately means that we are currently unable to offer you a quotation.

What is a business visitor?

Any person that comes to your home, or within the boundaries of your home, in association with any business connected to you or anyone living in your home.

Contact Us

Address

Suite 2B | West Village | 114 Wellington Street | Leeds | LS1 1BA

Call Us

01274 700 745

Email Us

home@f-net.co.uk